An estate plan gives you the power to decide what happens to your children and possessions after you’re gone. According to an AARP survey, 2 out of 5 Americans over the age of 45 don’t have a will. It may be that you want to get going with the process, but don’t know where to start. In our latest installment of the Fresh Start Speaker Series, Andrew Kaiser of the Kaiser Law Firm explains how to get your affairs in order once and for all.

Last Will & Testament

Without a Will, your assets will be dispersed by a probate court, which could take over a year to complete, leaving a headache for your heirs. Use this opportunity to declare who will manage your estate. This person will be your executor, and they will carry out the wishes stated in the Will.

You should also use your Will to name guardians for your children and pets, designating any assets you are leaving for their care. It may also be used to specify funeral arrangements (while a trust cannot).

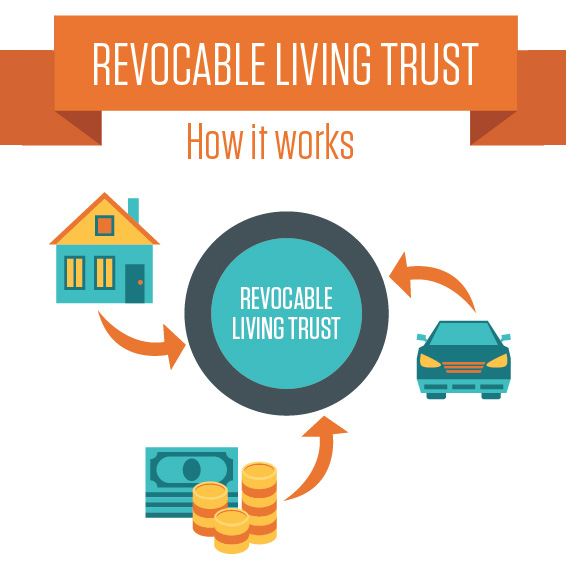

Revocable Living Trust

A Revocable Living Trust is another tool for passing assets to heirs while avoiding expensive and time-consuming probate. Without a Revocable Trust, a personal representative of a deceased’s estate is required to file the Will and report the details of the estate’s administration to the probate court. A Trust is not required to be filed with any court so it remains private while the Will becomes a matter of public record.

The general duties of the Trustee are taking over management of the Trust as well as paying bills and expenses and distributing the assets to the beneficiaries. Beneficiary designations for life insurance, retirement plans and bank accounts are powerful and take precedence over your Will. So it is extremely important to have these positions filed with each of your accounts.

The general duties of the Trustee are taking over management of the Trust as well as paying bills and expenses and distributing the assets to the beneficiaries. Beneficiary designations for life insurance, retirement plans and bank accounts are powerful and take precedence over your Will. So it is extremely important to have these positions filed with each of your accounts.

Power of Attorney

Choose someone to act on your behalf both financially and legally in the event you become incapacitated. This decision must be made while you are still competent to assign power of attorney.

IRA Inheritance Trust

As is the case with any assets held in trust, an inherited IRA will be better protected from creditors and from reckless spending. Moreover, leaving the IRA to a trust with a reliable trustee can ensure that only the minimum required distributions are taken, as long as there’s no pressing need for cash. This will provide your heirs with extended tax deferral and the chance to build superior wealth.

Do you have any experience or advice to share about preparing your estate? We’d love to hear from you!