A brand new year provides the perfect opportunity to make meaningful life changes, including improved financial wellness. These six financial resolutions can help get your year off to a promising start. Finances are not one size fits all…try a couple, do them all, space them out, tackle one a month. These are your goals, try what works for you:

1. Get on a Budget

Take charge of your finances by creating a budget. Start by calculating after-tax income and subtracting fixed monthly expenses. Then allocate portions of the remaining income for savings, important goals and a few things that just make you happy. If this sounds complicated, relax; today’s user-friendly budget apps can take a lot of the pain out of the process. Check out our free personal finance manager, Trends, to make tracking easy. To further simplify money matters, consider setting up automatic bill pay, an automatic savings plan and separate savings accounts for specific goals such as Holiday and Vacation Savings.

2. Build an Emergency Fund

Without a solid cushion, any unexpected job loss, medical challenge or serious property damage could lead to lasting financial hardship. An emergency fund with three to six months’ worth of expenses can protect your standard of living and offer peace of mind. Start small by committing to saving at least 10% of your income with a goal of saving one month of expenses. Once you do, increase your goal to two months and so forth. But remember, you must pay yourself first! This means that before you pay your bills, buy groceries, or anything else vital before setting aside a portion of your income to save. In essence, the first bill you should be paying each month is to YOU!

3. Start Banking on Your Future

Whether it’s starting up a savings account or contributing to your employer’s retirement plan, an individual retirement account, or stocks and bonds, where you put your money and how you allow it to work for you will help you get your financial life in order. Retirement may not be on the immediate horizon, but when the time comes it may well last 20 years or more. You’ll probably need somewhere from 70 to 90% of your final-year income for each year of retirement, and it’s unlikely that Social Security will be sufficient. Saving such a sizeable sum takes decades, so it pays to start early. Put as much as you can afford into tax-advantaged Roth or traditional IRAs, and if your job provides a 401(k) plan, contribute the maximum employer-matched amount. If you need help starting out, set up a complimentary meeting with Investment Services to discuss your retirement strategy.

4. Improve Your Credit

You likely know that credit scores affect financing approval and interest rates. But the influence of those three little numbers actually stretches much further. Prospective employers and landlords frequently check credit, so low scores may mean missing out on the best jobs and apartments. Credit scores also may affect insurance premiums, mobile phone offers, vacation costs, and even whether utility hookups require a cash deposit. For top scores:

- Pay all bills on time.

- Keep credit card balances at no more than 20% to 30% of the credit limit.

- Carry a mix of debt types such as credit cards, auto loans and personal loans.

- Monitor credit to catch and correct any errors or problems. Our Choice Checking Account offers ID Protect which allows you to view an updated version of your Credit Report every 90 days and alerts you of any key changes occur.

5. Knock Down Debt

Even with a great job, high-interest debt can sabotage financial health. To get back on track, consider concentrating efforts on your highest interest debt first while continuing to make timely smaller payments on all other obligations. When the first balance is satisfied, focus on the most expensive remaining debt and continue this way until you’re debt-free.

If debt from multiple sources is unmanageable, debt consolidation may help you regain control. This approach streamlines debts into one payment, often with reduced interest and a lower monthly cost. Depending on your individual situation, home equity financing, personal loans or zero interest balance transfer credit cards may be effective debt consolidation choices. Our Listening & Lending program offers solutions for even the toughest situations.

6. Educate Yourself

A well-informed consumer is critical to a strong and stable economy.Unfortunately, many Americans are unfamiliar with even the most basic economic concepts needed to make saving and investment decisions. In fact, research shows that more than half would fail a basic finance quiz. This lack of financial knowledge presents serious barriers in home purchases, retirement planning, and other financial choices. Being a lifetime learner is one of the most important values of the credit union—it’s even written into our Mission. We offer free seminars throughout the year about different financial literacy topics. Sign up for our bi-monthly eNewsletter, follow us on social media (facebook, twitter, instagram, pinterest, youtube) and check our website often for trending money issues. And if you have a question, ask!

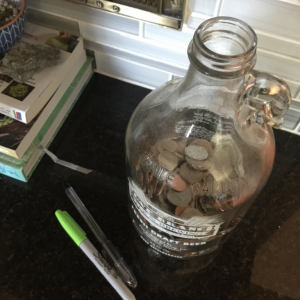

Bonus 2017 resolution idea: Save your change.

Once your jar is full, bring it into the credit union. Our coin sorting machine is free! Leave with cash in your hand, ready to reward your responsibility.

Smart money resolutions boost financial stability not just immediately but over the long haul as well. As the saying goes: “If you fail to plan then you are planning to fail.” As cliché as that may sound, it is important to realize that the first step of establishing your financial goals is the most important step to take—especially when attempting to get your financial life together. Once you establish what your goals for 2017 are, decide if they are S.M.A.R.T. This means they are Specific, Measurable, Achievable, Realistic, and Timely – and will help you organize your financial goals into bite size chunks that are actually DOABLE!

What are some of your New Year’s financial resolutions? Share them with us in the comments.