What’s in a number? Credit scores are basically your financial report card. Only now your financial habits are graded from 300-850. So, what makes up that score and how does it affect you? Barbara Davis, a Credit Analyst with West Community Credit Union, tackles these questions in a recent seminar, “Enhancing Your Credit Score.”

Everyone has a relationship with credit. Your score is predictive of how reliable you’ll be when paying back a loan by taking into account your previous history with lenders. In other words, it evaluates your “creditworthiness” and can be the defining factor in your ability to purchase a home or new car.

A commonly used acronym for credit score is FICO which stands for “Fair Issacs Company.” FICO scores are used to assess risk, determine approval of loans and how to price them. So, the higher the score, the more likely a lender will take a risk on you. Negative credit activity, such as foreclosures or repossessions, can affect higher scores significantly more than lower scores.

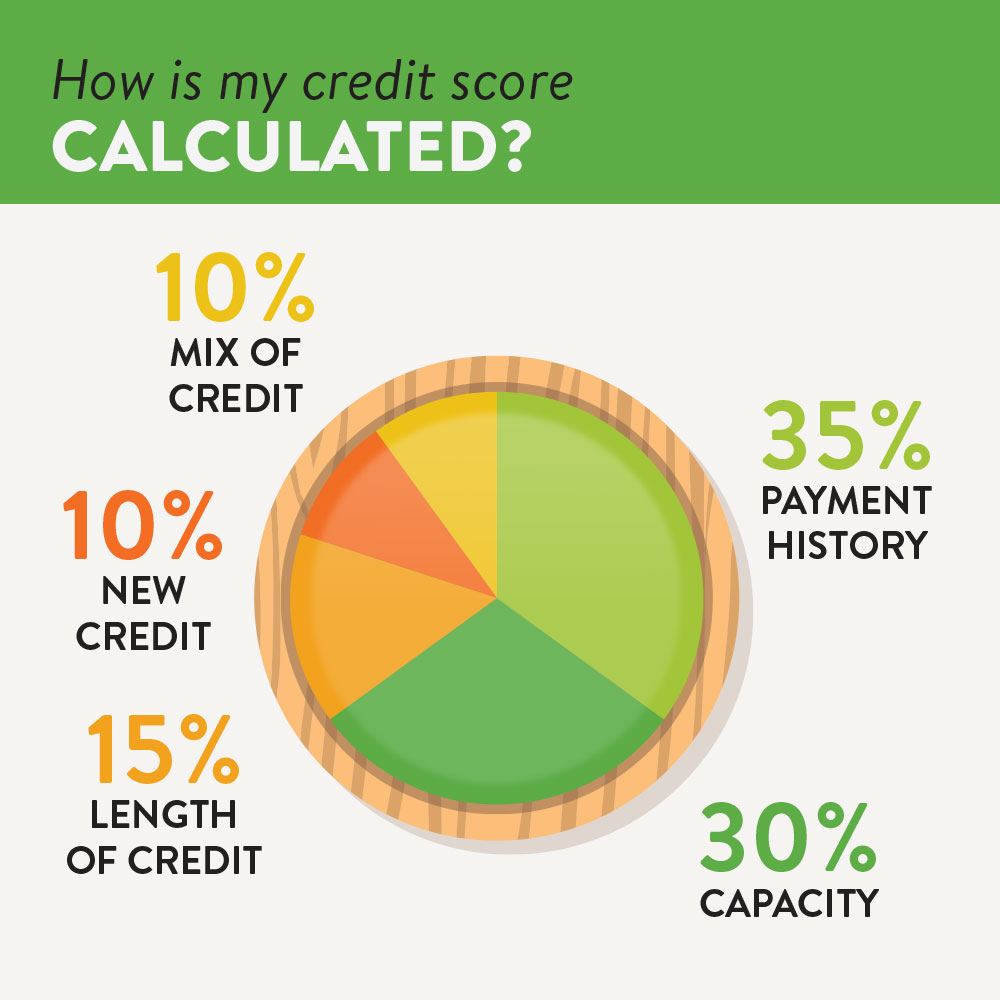

35% Payment History — Your on-time payment history is the biggest factor when it comes to your credit score. You may want to check your loan documents and credit card statements to see if you have a grace period (which is typically 15 days). Companies usually report all loans that have a payment that is 30 days past due.

30% Capacity — Capacity is a heavily weighted factor of your credit score. It refers to your credit cards and the amount of available credit on revolving accounts. It can be calculated by taking your total credit card balances and dividing it by your total credit card balance limits. It is best to keep your balances under 30% for good credit health. Credit cards are a very good way to build credit and you may not need to use them to keep your cards active (check with your lender concerning annual fees, etc.).

15% Length of Credit — Some people can be considered too responsible with their money. They hardly ever use credit, preferring cash. This can cause you to have a harder time getting credit than the guy who has debt. Just six months of on-time payments will get you “established,” but the longer your credit history, the more accurately a lender can assess your creditworthiness. Not using an open card will not move your score up or down, but closing the account will hurt your credit.

10% Debt Accumulation — This percentage refers to credit inquiries, which typically occur when you’re applying for credit and a lender checks your score to decide whether or not to approve you. These can negatively affect your credit, so we suggest when shopping around, to do so in a short period of time. Soft inquiries, such as pulling your credit for a job interview, auto insurance or other non-lending purposes do not affect your score.

10% Mix of Credit — Consumers with a mixture of revolving, installment (auto loans, personal loans) and mortgages generally have better credit scores because it indicates that more lenders are willing to grant them credit. Also, having a variety shows an ability to manage multiple kinds of credit.

ACTION PLAN TO INCREASE YOUR CREDIT SCORE

In order to start boosting your credit score, you must first become aware of your borrowing behavior. You can better understand the relationship between your financial activity and your credit score by reading your credit report. This is a very valuable tool for improving your score.

Follow this checklist to start boosting your score today:

- Pay your bills on time—this should be the top priority.

- Keep your credit card balances low.

- Rate shop within a focused period.

- Keep unused credit cards open, even if you do not plan to use them.

- Focus on correcting negative factors.

- Check your score regularly. You are guaranteed a free copy of your credit report every year.

Solutions for Debt: Trade Revolving Debt for Installment

If you have too much credit card debt or you just want it paid off much quicker, you may consider consolidating that debt into a fixed term signature loan or refinancing your vehicle as collateral. This could help you pay off your debt much faster with one low monthly payment. If you think you may need help, see our Listening & Lending® Solution.

A good credit score is critical if you ever plan to apply for student loans, buy a car, or get a mortgage. If you want to review your credit report or talk to someone about establishing credit, eliminating debt or consolidating it, schedule a meeting with a Member Services Consultant at 636.720.2400 or stop by a branch.