Certificates of deposit are a form of time deposit, an arrangement in which money must stay in the bank for a certain length of time to earn a promised return.

A CD almost always earns more interest than a regular savings account. Financial institutions pay extra for the right to hold a lump sum for a period of months or years, known as the CD’s “term.”

The National Credit Union Association insures your CD up to $250,000, just as with any deposit account. So the only risk to you is the penalty you’d have to pay if you withdrew the money before the CD term was up.

The longer the term, the higher the interest rate.

Putting more money into your CD can also boost your annual percentage yield, the effective return on your deposit that comes from compounding the interest over the course of a year.

You’ll earn interest on the deposit until it matures, at which point you can collect the full amount. Depending on your circumstances, you may benefit from a particular type of CD, such as a jumbo CD, which has a high minimum-balance requirement, or an individual retirement account CD held in a tax-advantaged account.

When should I get one?

CDs work best for savers who have the financial breathing room to sock away money for some time. You’ll also need to be able to meet any minimum deposit requirements, typically $500.

When deciding on a deposit amount and a term length, consider your other financial commitments and your time horizon. Make sure you’ve already banked enough emergency savings — ideally three to six months’ worth of living expenses that you can access easily in time of need. By contrast, any money you put into a CD will be locked down until the end of the term; withdrawing it ahead of time means you’ll pay a penalty.

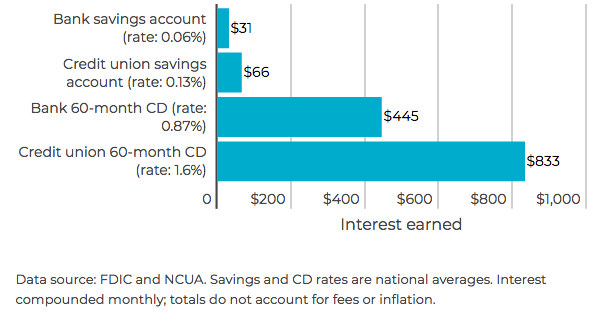

How CD returns compare to savings account returns

Say you were stashing $10,000 in the credit union for five years. If you decided to put it in a CD rather than a savings account, your money would earn hundreds of dollars in additional interest. Calculate your possible earnings with our Certificate of Deposit Calculator.

Industry averages compiled by Nerdwallet:

Oh and Hey…Our CD Rates Increased!

$500 minimum opening deposit

Whatever your future holds, we’re positive it holds something worth saving for so take advantage of these fantastic rates and talk to Member Services about opening a CD today!