Our mobile banking app lets you conveniently and securely access your accounts anytime, anywhere. All you need is an eligible account and a smartphone with access to the Internet. Maybe you already have the app, but you may not be utilizing all the tools available:

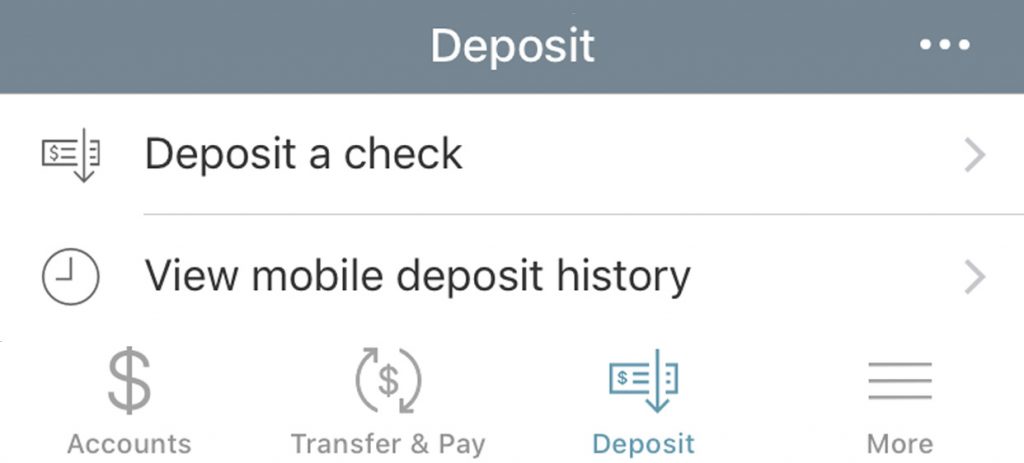

1. Deposit Your Checks for FREE

Our free mobile deposit is fast, simple and secure! Just endorse the back, write “For Mobile Deposit”, snap a picture, and you’re set! Your funds are typically available within 2 business days.

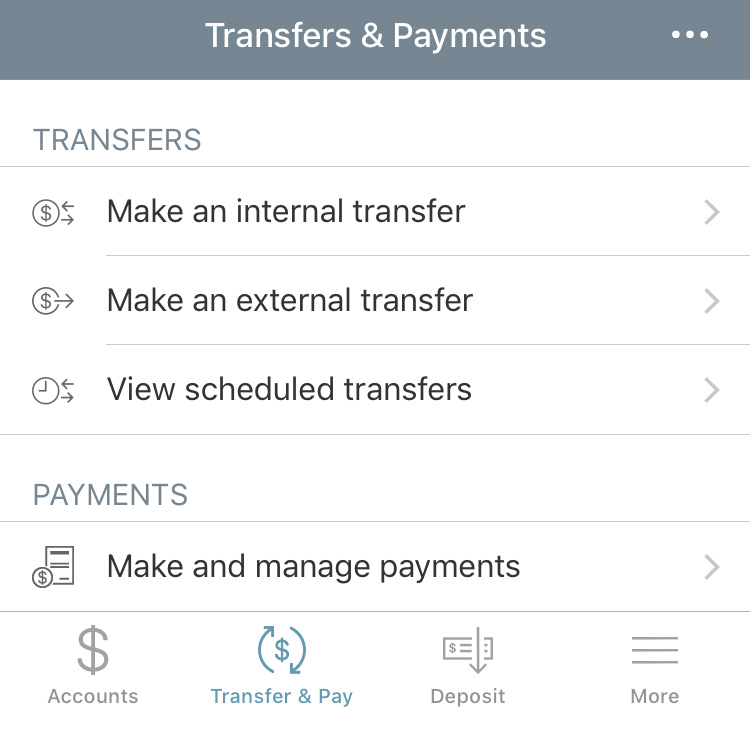

2. Pay Virtually Anyone

You can pay unlimited merchants and individuals immediately, or schedule a future payment. From the local bakery to a Fortune 500 Company, even your babysitter, you can send money to virtually anyone. Plus, you’ll have access to your payment status and history. And it’s all FREE! Payments can often be received in as little as one business day, even that same afternoon if necessary.*Expedited payment fee may apply.

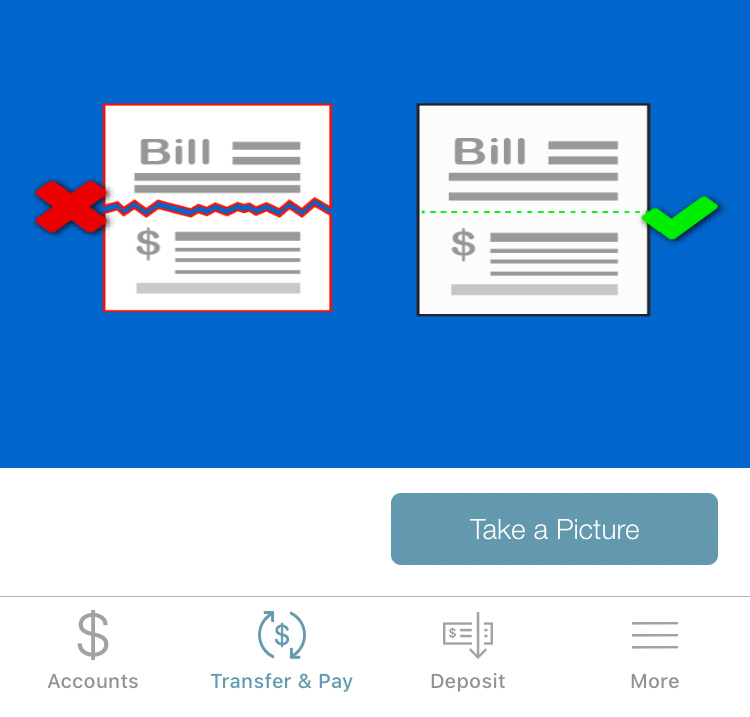

3. Pay Bills with Your Camera

Did you know you no longer have to fill out all the information in the Bill Pay to send money to your contacts?! Now you can simply snap a photo of your bill and your bill information is automatically entered. Here’s how it works.

- Select Payments. Enter your Mobile Banking password to access the menu of Bill Pay options.

- Activate Bill Capture. With your bill ready, tap on the Bill Capture tile.

- Snap a picture. Simply take a picture of your bill to quickly make a payment immediately or access it from your To Do List later. DO NOT tear off the mail in portion of your bill – use the whole page. Hold your phone above it so the camera can see the entire bill. On-screen instructions will help guide you through each step.

- Track your payment. Once your payment has been scheduled, you can keep track of its status through the Mobile Banking app.

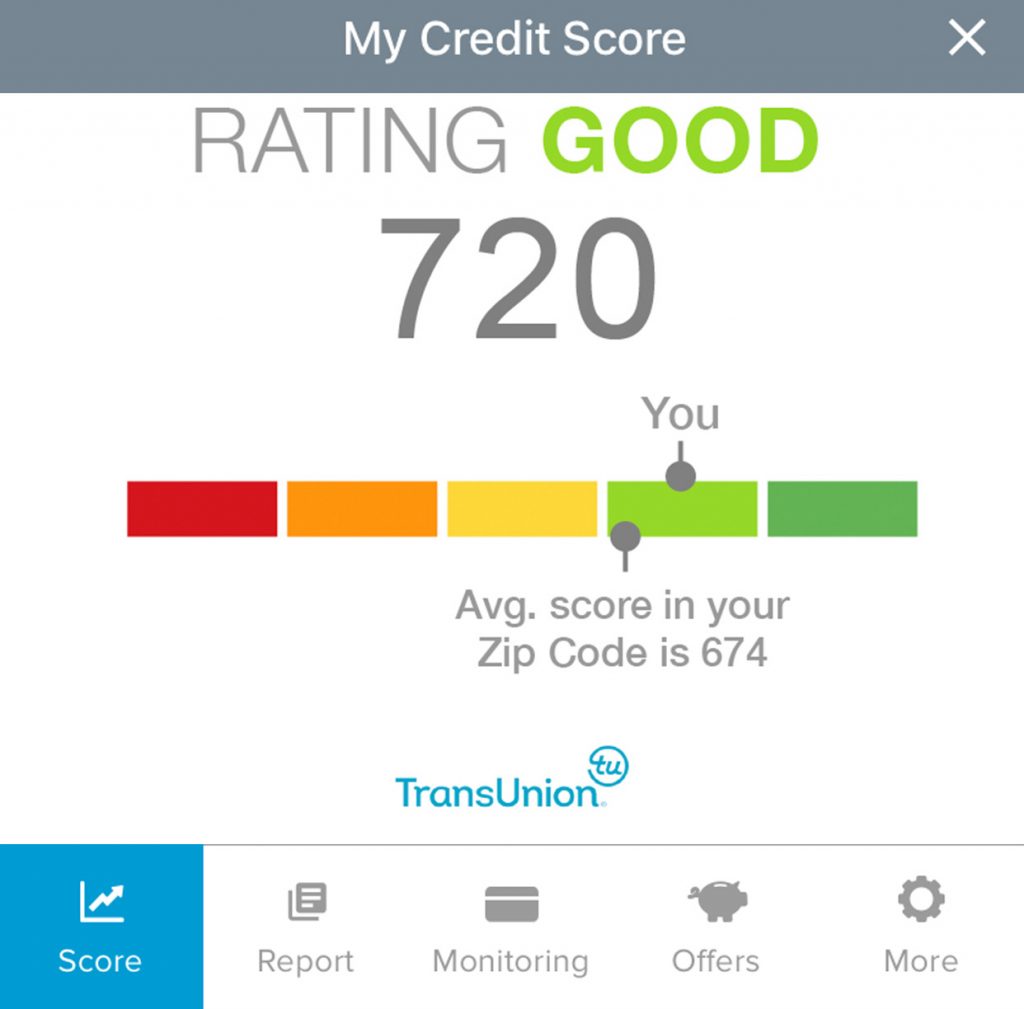

4. Check Your Credit Score

Your credit score affects every aspect of your financial life – from loan rates to cost of insurance. The better your score, the more you save. That’s why we’ve made it easy to monitor your score and credit activity for FREE in Online Banking and our Mobile Banking App! Secure, free access to your credit score puts you in charge. The daily credit alerts could be the earliest indication of fraud – allowing you to take control quickly.

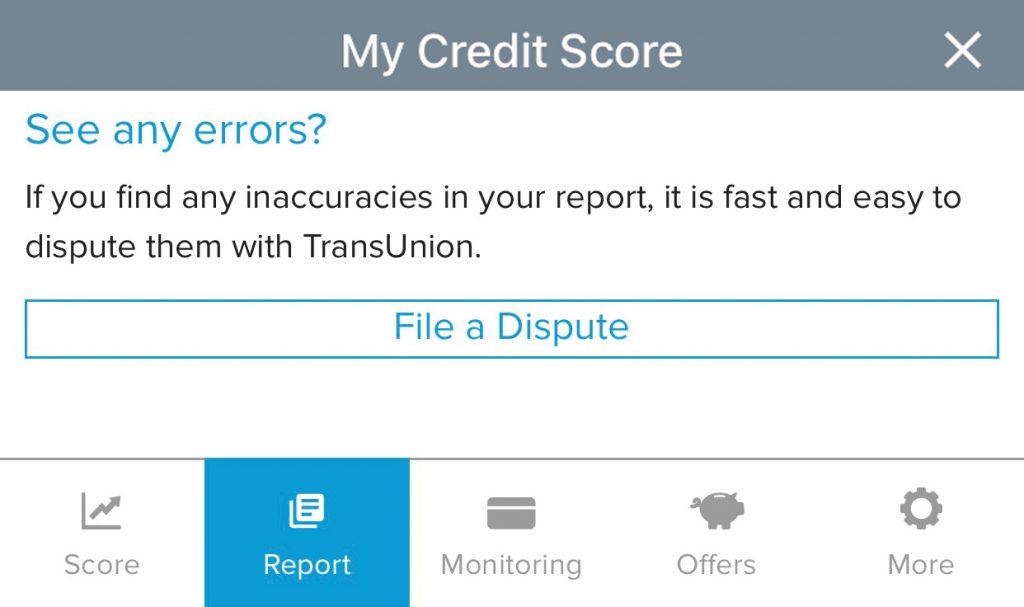

5. Initiate Disputes on Your Credit Report

You have access to free monthly credit reports and alerts within the Mobile Banking App which makes monitoring your credit super simple. If you happen to find any inaccuracies in your report, it is fast and easy to file a dispute with TransUnion directly from the app.

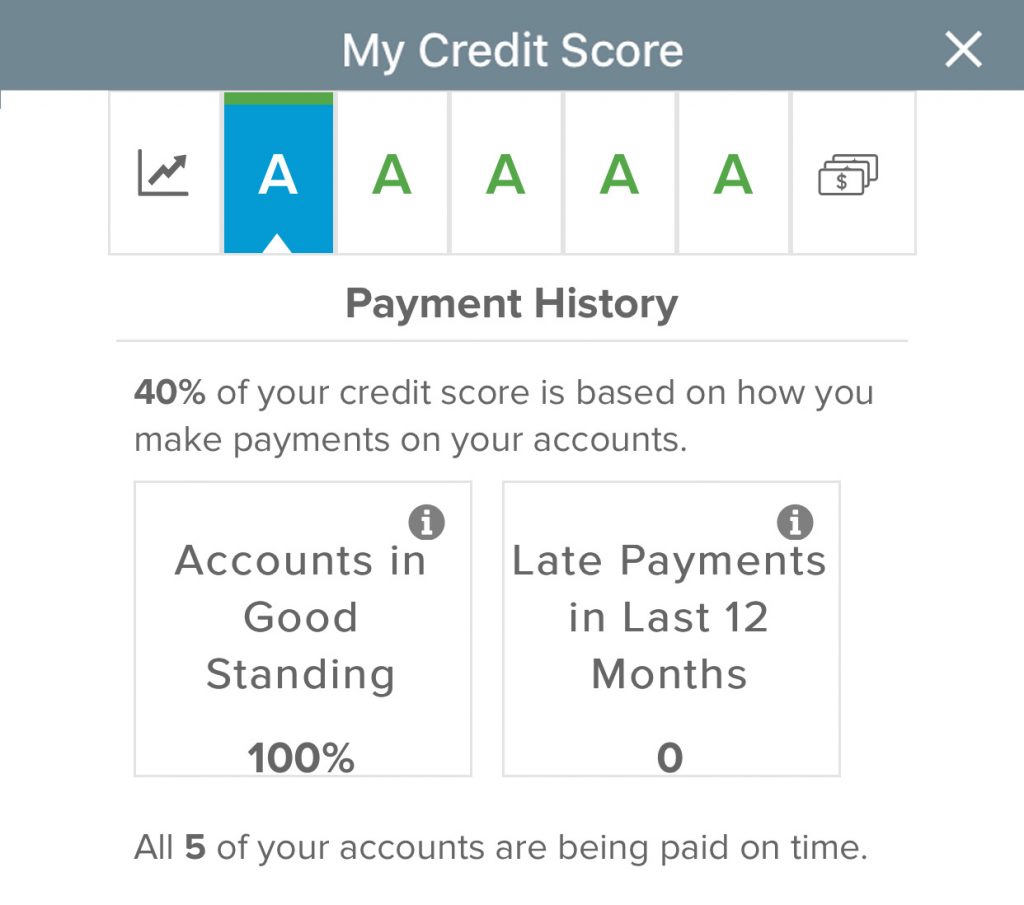

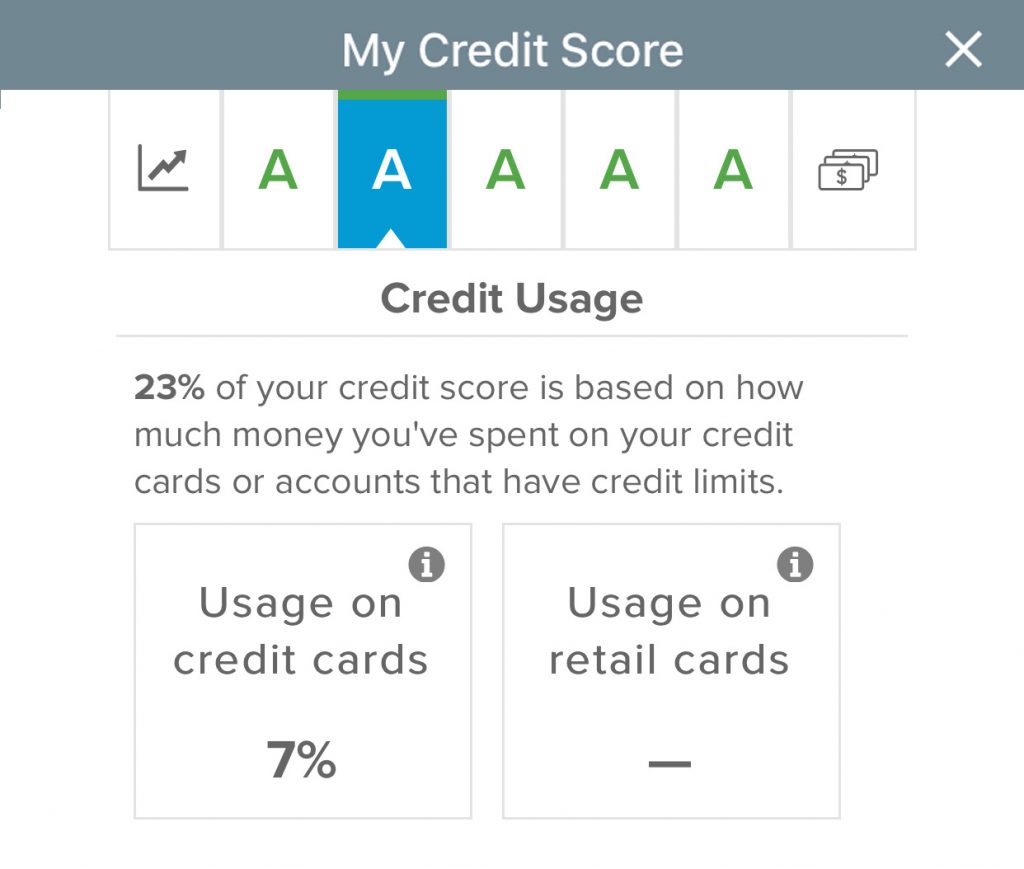

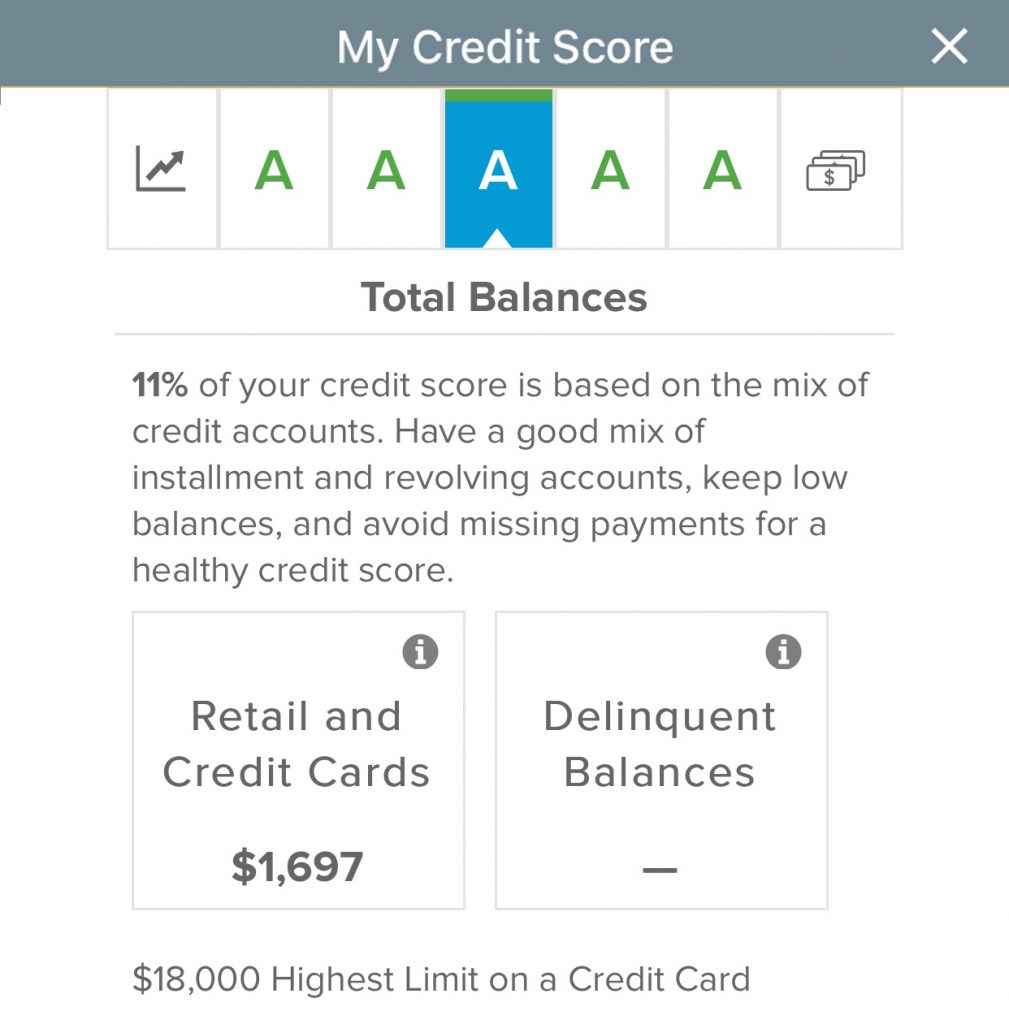

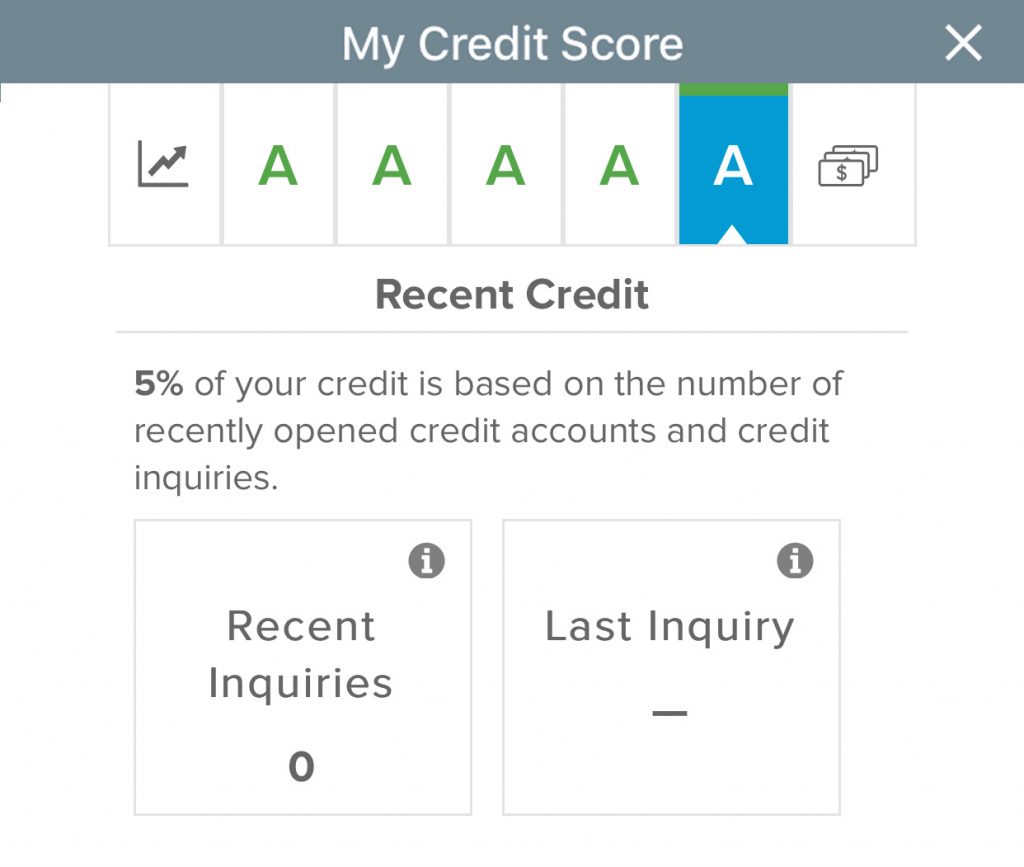

6. Review Your Financial Report Card

To see the details behind what made up your score, you can select the letter grades at the top of the “My Credit Score” page. Each tab will dive deeper into what affected your score as well as actions to improve it. Categories that affect your score include Payment History, Credit Usage, Total Balances, Credit Age, Recent Credit and Your Accounts.

However you check it, it’s a good idea to know your credit score, and work to improve it.

Learn more about the time-saving, secure features offered with Mobile Banking. Watch our demo and take a quick tour. As you’ve learned, it’s easy to manage your money anywhere and you can easily and safely view balances, transfer money between accounts, pay bills, and more.

If you are a new Mobile Banking user, visit your app store; Apple App Store for iPhone users or Google Play for Android users, and download the West Community Credit Union app today!