Banks and credit unions essentially offer the same products and services, but there are huge differences in the way they operate. The main difference between banks and credit unions is in their structure. Banks are for profit, while credit unions are member-owned not-for-profits.

This means that banks have numerous expenses that credit unions simply don’t have. Banks have to pay their shareholders, their private investors, and even their board of directors (credit union boards are typically volunteers elected by credit union members)—and all this is in addition to regular operating costs. Banks are set up in a way that allows a select group of people to make money off of your banking activity.

The Credit Union Difference

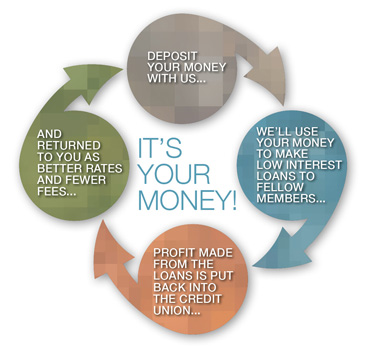

Credit unions, on the other hand, are set up in a way that allows all of its members to benefit from its profits. Once its operating costs are covered and reserves are set aside, the profits are distributed back to members in the form of free banking products, lower interest rates on loans and higher interest rates on savings accounts. Credit unions in the United States are also exempt from federal and state income taxes which translates to even more profit that comes back to members.

Despite this, many people put more thought into building their Netflix queue than they do choosing their financial institution. At the end of the day, choosing a financial institution is a personal decision with a huge influence on how you manage your money, but also WHO benefits off of your money. If you take some time to ask questions and compare services, you’ll find the best home for your finances.

But what about convenience?

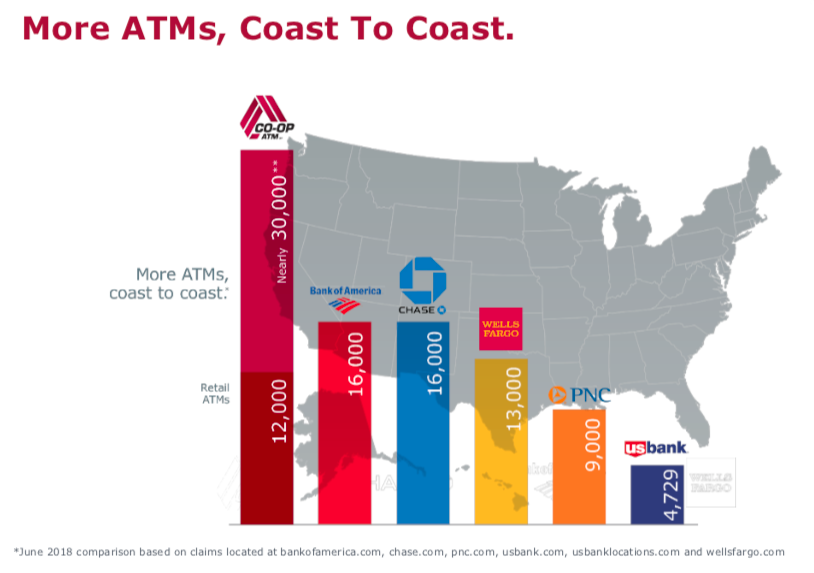

Credit unions that are connected by CO-OP share their resources with thousands of other credit unions nationwide (something that banks don’t do). Through this network, you have access to 30,000-plus ATMs without fees and 5,400 branches to make in-person transactions just like at your home branch.

We also understand the growing need for financial technology and offer convenience services such as online and mobile banking with digital pill pay, mobile deposit, free credit score access and so much more.

Make the Switch and Save!

We’ve made switching your accounts easier than ever by partnering with ClickSWITCH! This service removes the hassle of contacting all your billers to make changes and helps ensure you don’t miss a payment when you change financial institutions. Your account information is transferred into one location with just a few clicks in as little as 10 minutes!

So if you’re tired of bank fees and feeling like a number instead of a person, contact us today to get your ClickSWITCH SwitchTRACK code. If you have questions please call us at 636.720.2400 or stop by a branch.